E-mobility subsidies 2023

Electromobility continues to grow. With the start of the new year, there are some changes to the subsidy guidelines, especially for company electric vehicles. Here, you will find a detailed summary of the subsidies for company electric vehicles.

Subsidies for vehicles

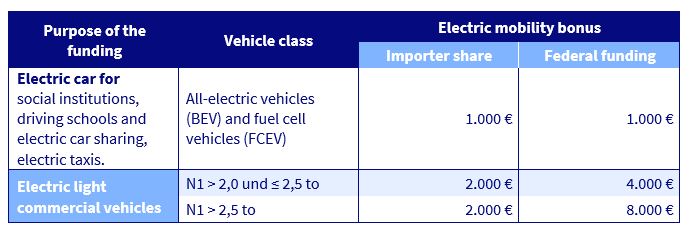

After the mobility subsidy for companies was already cut in 2022, there will no longer be a subsidy for electric cars purchased by a company in 2023. Exceptions are vehicles for social institutions, driving schools and electric car sharing as well as electric taxis. An electric mobility bonus of 2.000 € will continue to be granted for such vehicles.

There is no change in the subsidies for light commercial vehicles. Depending on the vehicle class, companies are subsidised with an amount between 6.000 and 10.000 €.

Funding for charging infrastructure

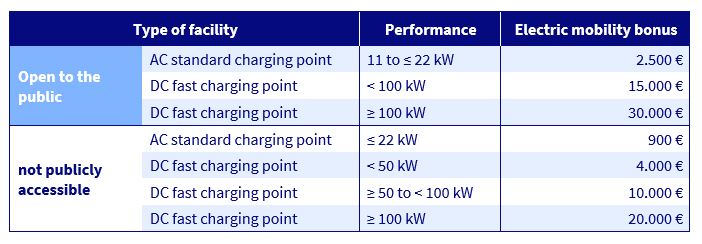

The amount of financial support for charging infrastructure remains unchanged in 2023. Depending on the type of facility, subsidies of between 900 € and € 30.000 € can be applied for.

The maximum amount of funding is 30 % of the environmentally relevant investment costs.

The guide "E-mobility for companies, local authorities and associations" and all further information can be found at www.umweltfoerderung.at.

Tax relief

Electric cars are exempt from both the NoVA (=normal consumption tax) and the motor-related insurance tax. Plug-in hybrid vehicles, on the other hand, are only taxable in the motor-related insurance tax for the internal combustion engine portion (performance and CO2 emissions).

The non-monetary benefit does not apply to the private use of all-electric company vehicles. Otherwise, depending on the vehicle and CO2 emissions, this amounts to 1,5 - 2 % of the actual acquisition costs, up to a maximum of 720 or 960 €.

All-electric vehicles are entitled to input tax deduction. If the purchase price is below the reasonable limit of 40.000 € (incl. VAT and NoVA), the input tax deduction is unrestricted. If the purchase price exceeds 80.000 €, no input tax deduction is possible.

If the purchase price is between 40.000 € and 80.000 €, only the portion that exceeds the reasonable limit of 40.000 € must be taxed (luxury tax line).

Since the beginning of the year, there has been a benefit in kind-free amount if the charging costs at the employee's place of residence are reimbursed by the employer. The only requirement is that the charging equipment used must ensure that the charging amount is clearly allocated to the e-car. The relevant value is set by E-Control and is 22,247 cents / kWh for the year 2023. If it is not possible to allocate the charging amount to the charging device used by the employee, a lump sum up to an amount of 30 € / month can be paid out to the employee tax-free.

The purchase and installation of a wallbox at the employee's place of residence, if financially supported by the employer, is also tax and duty-free as of this year. In addition, no non-cash benefit has to be paid for costs of up to 2.000 €.

Sources:

https://www.klimafonds.gv.at/wp-content/uploads/sites/16/Leitfaden_EMob_Gewerbe_2023.pdf

https://www.oesterreich.gv.at/themen/bauen_wohnen_und_umwelt/elektroautos_und_e_mobilitaet/Seite.4320010.html

https://www.wko.at/service/steuern/Vorsteuerabzug_bei_PKW_und_Kombi.html

https://www.ris.bka.gv.at/Dokumente/BgblAuth/BGBLA_2022_II_504/BGBLA_2022_II_504.html

https://www.beoe.at/laden-von-firmen-e-fahrzeugen-zuhause/